Hey Les, where's the market correction?

As we move through 2023, our portfolios have accumulated higher levels of cash than normal. We are currently at 22 per cent in direct cash or cash equivalents with another 5-10 per cent in cash via our investment partners.

Many equity valuations were, and continue to be, unrealistic. The bulk of the companies (S&P 500) driving this year’s gains (the Magnificent Seven or FAANG+) are very expensive, while returns on low-risk high interest savings accounts (cash) have increased substantially. Why would we take extra risk, in an uncertain market, when you can get 5.5 per cent on cash and wait to see what happens?

So, where is the market correction and recession we are all looking for? Are we going to get the fabled “soft landing”? Is the government (U.S. policy) going to make everything and everybody happy?

If I can quote David Rosenberg from his most recent article, It’s All About the Lags:

“Either the financial community is replete with neophytes with no experience that have never lived through an entire business cycle, or people with extremely short memories.”

The full article can be found on LinkedIn under David Rosenberg or at: https://www.linkedin.com/pulse/its-all-lags-david-rosenberg/

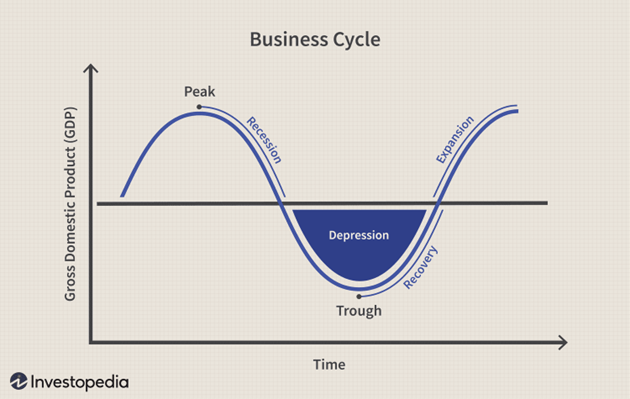

All the indicators we cover point to some kind of recession and subsequent market correction. As David highlights above, the business cycle has been the same for as long as we have been studying it. Things expand until something breaks and then, we head into a recession.

The Conference Board (U.S.) advised, in their latest release, that their Conference Board Leading Economic Index has been in decline for 15 months – the longest streak of consecutive decreases since 2007-08. They forecast that the U.S. economy is likely to be in recession from Q3 2023 to Q1 2024. (https://www.conference-board.org/topics/us-leading-indicators )

Barron’s website has an article from Mark Hulbert highlighting how insider buying is at its lowest point since 2013. Insider buying, which is the purchase of shares in a company by directors, officers or executives, has always been seen as a strong indicator either way (https://www.barrons.com/articles/corporate-insider-stock-buying-bear-market-15119b46).

One more interesting read from the Financial Post brings to our attention how an IMF report has Canada at the highest risk for mortgage defaults within advanced economies (https://financialpost.com/news/imf-warns-canada-highest-risk-mortgage-defaults ). This is in line with other statistics showing a substantial decrease in savings, an increase in revolving debt and higher credit card balances.

At some point, the cash will run out and the economy will slow, and we may head into a recession. To quote someone from the investment world:

“The investment world can stay irrational much longer than you can stay solvent.”

Until that time, we will just have to wait for the neophytes to figure it out.

IMPORTANT INFORMATION REGARDING THE ATTACHED:

Raymond James Ltd. (“RJL”) is making the attached newsletter or report (the "Third Party Report") available to you for your information and convenience only. The Third Party Report is prepared by another company, which is noted in the report itself (the "Third Party Provider"). The Third Party Provider is entirely responsible for the Third Party Report and its contents. RJL does not review, endorse or approve Third Party Reports and we assume no responsibility for the accuracy, completeness or timeliness of any such information or for updating such information, which is subject to change without notice at any time. As such, information and analysis in the Third Party Report may be out of date, inaccurate or incomplete. The Third Party Report is not RJL research nor is it an RJL communication. Under no circumstance is the information contained within the Third Party Report to be used or considered as an offer to sell or a solicitation of an offer to buy any particular investment, security, commodities or forex product. Any recommendation, opinion, analysis, advice or fact contained in the Third Party Report may not necessarily reflect the views of RJL or our employees. RJL assumes no responsibility for any recommendation, opinion, analysis, advice or fact contained in the Third Party Report and expressly disclaims any responsibility for any decisions or for the suitability of any product or transaction you choose to enter into based on it. The client alone will bear the sole responsibility of evaluating the merits and risks associated with the use of any information contained in the Third Party Report before making any decisions based on such information. Raymond James Ltd., member-Canadian Investor Protection Fund.