There Seems to be a Consensus Brewing

“Be greedy when others are fearful and be fearful when others are greedy”.

— Warren Buffett

Our herd mentality has been around forever, and I think we all know that the herd offers protection (just ask a gazelle being hunted by a lion). There is safety in numbers. When it comes to investing many would argue the opposite. As the Buffett quote above highlights, it is not always best to stick with the herd.

We guide our portfolios to garner reasonable returns without chasing the herd. The Mag 7, or Mag 1 these days (Nvidia), have been leading markets higher for some time and we were not part of them (directly). In hindsight, it would have been nice to ride their wave as they flew to ever higher valuations and prices.

When we looked at these stocks and all the fanfare around the AI revolution, it reminded me of Tom Hanks in the movie Big. His character Josh didn’t get it and I must admit I never really got the AI craze. AI has been around since the 50’s. Movies have been made about it destroying our world. It is nothing new.

Movieclips (2015, May 29). Big (1988) - Josh Doesn't Get It Scene (3/5) | Movieclips. [Video File]. Retrieved from https://www.youtube.com/watch?v=3ERuhks3GNk

So, what is the consensus now? The general view is that AI is going to change everything and that those who are early adopters will profit from this change. Get in now while you still can!

Well, we have been here before. The Nifty 50 of the 1970’s, the Tech Bubble of 2000 or the rock-solid housing market of the 2007-8 era. They all showed the problems of following the herd.

The consensus I am seeing now, within most of the spaces I read, is that we may just be on the verge of another “bubble” that is ready to pop. What is it that these other analysts and colleagues are looking at?

- Valuations – All time highs on many large cap stocks.

- Market concentration and breadth – As the graph above shows, the market leadership is very narrow. Very few stocks (10 out of 500) are leading the upward charge.

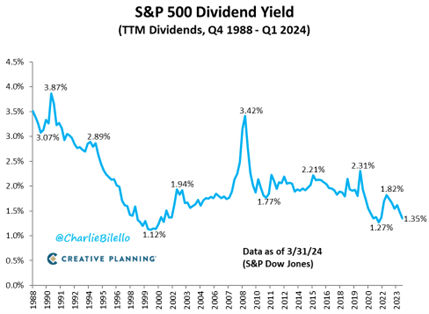

- Dividend yield – The average dividend yield for the S&P 500 (US) is now below 1.30%. The second lowest in history. When was the lowest in history? The first quarter of 2000! (see below).

- Insider selling – Look who has been selling stock lately.

- The short interest is at extreme lows. No one wants to bet against the market.

I could go on, but I will stop here.

The bottom line is that we are still cautious. We are still holding cash in high interest savings (HISA) and may look for ways to build this store. I have no idea what the trigger could be or how long it could take to get there, but I am pretty sure it will be entertaining.

Les Consenheim is a portfolio manager with Raymond James Ltd -Consenheim Wealth Management and can be reached at 372-8117 or les.consenheim@raymondjames.ca Raymond James Ltd. is a member CIPF.